The ultimate goal of today’s renters is to own their own home. But many just continue to pay rent month to month and miss out on the emotional and financial advantages.

The ultimate goal of today’s renters is to own their own home. But many just continue to pay rent month to month and miss out on the emotional and financial advantages.

I can recommend a mortgage professional that will help you explore programs for low or no down payment. Veterans often get special consideration and can get into a home with no down payment or closing costs. USDA has some qualifying areas with zero down payment programs. FHA requires a down payment of 3.5 percent. There are also conventional programs for 3 to 5 percent down.

If you have credit problems, you will need some expert advice about your situation. Borrowers who have had foreclosures or bankruptcies may be eligible to purchase a home after a waiting period. And other credit issues have some short term fixes. Consulting with a skilled mortgage professional may help you to overcome your unique credit problems.

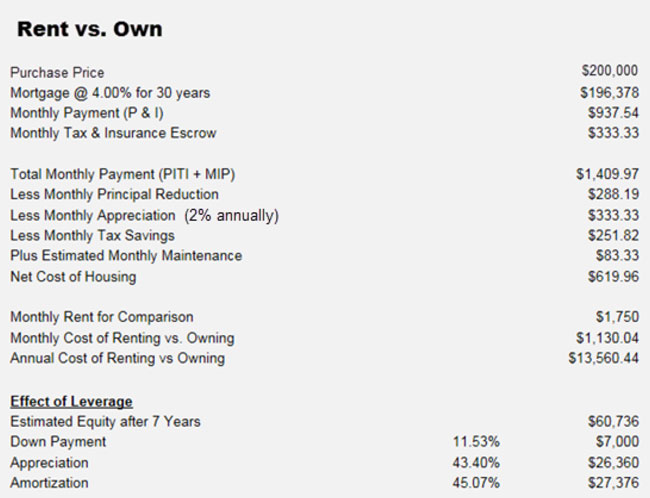

Renters often realize a lower cost in housing when they become owners. Appreciation of the home, coupled with tax savings and amortization make owning a home less expensive. Realized savings in your first year of ownership could be more than your required down payment.

Below I have provided you an example of Rent vs. Own considering a purchase price of $200,000.

Don’t let the fear of the unknown grip you Experiment with some numbers and then contact me for a recommendation of a mortgage professional who can give you accurate information about your situation. Then once you are ready to start searching for Fairfax homes for sale I can get you set up!

You can get a FREE Market Snapshot Report of Your Home’s Value, or get a FREE Listingbook Account so you can Search All Homes For Sale just like a Realtor. Put that data you need at the tips of your fingers!