In 2017, the Tax Cuts and Jobs Act increased the standard deduction for married couples to $24,000. In some instances, homeowners may be better off using the standard deduction than itemizing on their return. Previously, homeowners could get a better benefit with itemizing but there is now a $10,000 limit of state and local taxes (SALT) to consider.

In 2017, the Tax Cuts and Jobs Act increased the standard deduction for married couples to $24,000. In some instances, homeowners may be better off using the standard deduction than itemizing on their return. Previously, homeowners could get a better benefit with itemizing but there is now a $10,000 limit of state and local taxes (SALT) to consider.

So, let’s look at this hypothetical homeowner to see how an “old” strategy might benefit them even if they haven’t ever used it. Called “bunching,” this strategy calls for timing payments in a tax year so they can be combined to make a larger itemized deduction.

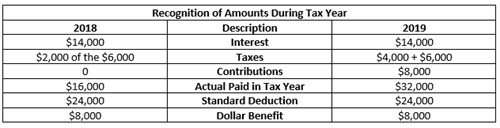

Our hypothetical married couple filing jointly has a $285,000 mortgage at 5 percent for 30 years that has about $14,000 in interest being paid. The property taxes are $6,000 and they have $4,000 a year in charitable contributions for a total of $24,000 of allowable itemized deductions on Schedule A.

With the itemized deduction being the same as the Standard Deduction it doesn’t matter which option they choose. But, if they were to pay their interest because they must make timely house payments but only pay $2,000 of the 2018 property taxes in December of 2018 and the balance of the $4,000 in January, they transfer part of the deduction into 2019.

And if they move their intended charitable contribution for 2018 to January of 2019, it makes that deductible on their 2019 return.

Since the total deductible amounts paid out in 2018 was $16,000, the taxpayers would have an $8,000 benefit that year from taking the Standard Deduction.

Let’s now assuming they will make the same $4,000 charitable contribution in 2019 during the year and paid the house payment and property taxes on time, their total deductions for 2019 would be $32,000 which is $8,000 more than the Standard Deduction.

In this example, the taxpayers in 2018 and 2019, would benefit a total of $16,000 in tax deductions by bunching and electing to take the standard deduction one year and itemizing the next.

This is only an example but if your situation is similar, it might benefit you to consider an alternative when to take the standard deduction and when to itemize. This is a conversation you need to have with your tax professional to see if it would work for you.

Want some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!