Just about two months until your 2014 tax returns are due. Whether you are doing them yourself or having a professional prepare the returns, you need to make sure you have all your deductions accounted. Below is a list I have created that will serve as a reminder to check and see if they apply […]

Tag Archives: tax deductions

Can I Make Money on my Home?

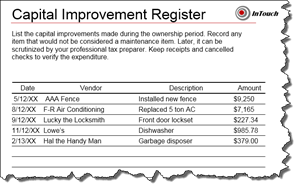

As a homeowner, you may often wonder if spending money on repairs or improvements for your home will net you any return. If you spend money on capital improvements, then you raise the base cost of your home. When you sell your home, these capital improvements can lower your capital gain and save you taxes. […]

Shifting Debt to Tax Deductible

Available to homeowners is the Mortgage Interest Deduction for up to $1,000,000 of acquisition debt on both their first and second home. If they have Home Equity debt they can also deduct interest on up to an additional $100,000. Home Equity Debt can be used for any purpose such as educational or medical expenses, buying […]