Regardless of whether you’re entitled to $250,000 or $500,000 of exclusion when you sell your home, prices have gone up so much in the past two years, you may be approaching the limit where you might have to pay tax on the excess when you sell. Any improvements you have made to the home during […]

Tag Archives: capital gains tax

Can I Make Money on my Home?

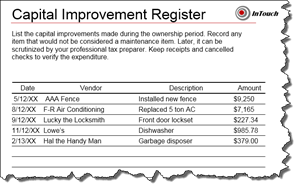

As a homeowner, you may often wonder if spending money on repairs or improvements for your home will net you any return. If you spend money on capital improvements, then you raise the base cost of your home. When you sell your home, these capital improvements can lower your capital gain and save you taxes. […]