Will a rental property give you the rate of return you are looking for? My modified annual property operating data may be just what you are looking for.

Investors consider different rates of return to determine whether a property will generate the yield they expect. Often the simplest of calculations can tell you whether you want it or not and if you can get additional things like tax advantages and appreciation, it just makes it that more attractive.

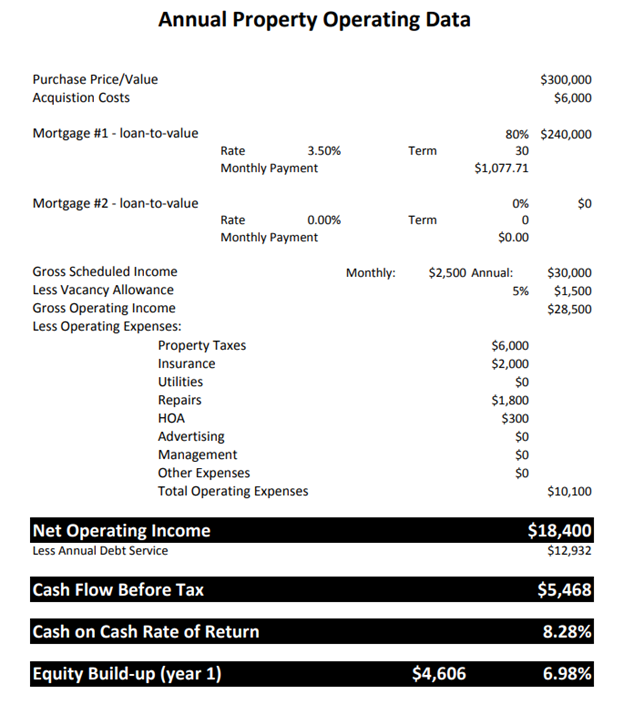

We will look at the first yield which is the Cash-on-Cash rate of return. It is calculated by dividing the initial investment, usually down payment and closing costs, into the Cash Flow Before Tax.

We arrive at a Net Operating Income, by taking the gross scheduled income, less the vacancy allowance, and all operating expenses. From that, we deduct the annual debt service which is the principal and interest payment times 12. Our remaining amount is called Cash Flow Before Tax.

In my example, an initial investment that included down payment and closing costs of $66,000 was divided into the Cash Flow Before Taxes of $5,468 to get an 8.28 percent Cash-on-Cash rate of return.

Next, we will consider equity build-up. Each payment you make on an amortizing mortgage pays a portion toward the principal balance to retire the loan. It is calculated by dividing the initial investment into the principal contribution for the year.

If we continue with my example, $66,000 is divided into the principal reduction for year one of $4,606 to get a 6.98 percent Equity Build-up rate of return.

This is an easy approach to understand because it is not complicated by depreciation, anticipated appreciation, holding period, recapture of depreciation, or long-term capital gains. Simply rent the property, pay the bills, and if there is money left over, it pays a return on your initial investment.

The same principle applies to Equity Build-up. Make payments on your mortgage, reduces the loan and although you do not have access to the money as you would cash flow, it is definitely tangible.

To determine whether an ROI on a rental property is good, compare it to what your initial investment is earning currently. Ten-year Treasuries are earning less than two percent. Certificates of deposit are earning less than one percent.

For more information, download the Rental Income Properties guide and schedule an appointment with me to discuss your specific situation.

I can provide Insider Information on Fairfax VA homes for sale. Get you a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!