Lenders use credit scores to measure a borrower’s creditworthiness. Although several different companies offer credit scores, the Fair Isaacson Corporation or FICO is the one that is most often used.

Lenders use credit scores to measure a borrower’s creditworthiness. Although several different companies offer credit scores, the Fair Isaacson Corporation or FICO is the one that is most often used.

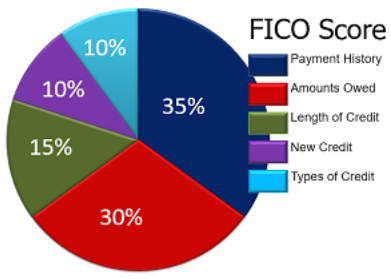

FICO uses five key components to determine a borrower’s overall credit score or rating. The highest percentage, 35 percent, is judged on payment history which shows whether the borrower made timely payments and adhered to the terms of the credit agreement. An adverse effect on this part of the score would be late payments, missing payments or going into default.

Credit utilization, the second largest component at 30 percent, is the amount owed in relation to available credit. A borrower might have available credit of $20,000 with a $4,000 outstanding balance. This 20 percent ratio would be considered acceptable. However, if the borrower owes $15,000 on a $20,000 credit account, the ratio would be 75 percent and would affect the credit score negatively. FICO states that people with around 7 percent credit utilization have the best average scores.

Fifteen percent of your credit score is determined by the length of time each credit account has been opened and the account activity. Your credit provider has a better indication of your long-term financial behavior if you have a longer credit history. Having open accounts but no activity does not offer a lender much information.

Ten percent of your credit score is new credit or types of credit. A new obligation or new credit can adversely affect your credit score because it is without a repayment history. For this reason, your realtor may ask you to refrain from making any new purchases when you’re looking to buy a new home. Credit types include both installment and revolving debt. A good mixture of these two can indicate less risk for lenders.

To determine creditworthiness lenders use a combination of all five areas noted above to create your total score. Credit scores can be confusing because they are not all mortgage credit scores. Mortgage credit scores determine whether the lender will make a mortgage and at what interest rate.

Finding and using a trusted mortgage professional is the best place for you to get your credit score especially if you’re planning on purchasing a home. This professional can suggest things you can do to improve your credit score, if necessary. Buying a home is one of the largest investments in your life; so don’t make it a DIY project.

Want some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or get a FREE Listingbook Account so you can Search All Northern Virginia Homes For Sale just like a Realtor. Put that data you need at the tips of your fingers!