In 1913, the 16th amendment allowed personal income tax and one of the allowable deductions was mortgage interest paid on your principal residence. A follow up in 2017, Tax Cut and Jobs Act reduced the maximum amount of acquisition debt to $750,000 from $1,000,000.

Acquisition debt is the amount of debt used to buy, build or significantly improve a principal residence, up to the maximum allowable amount. A common misunderstanding among taxpayers when refinancing is that you are entitled to deduct all the interest on the refinance even when taking cash out.

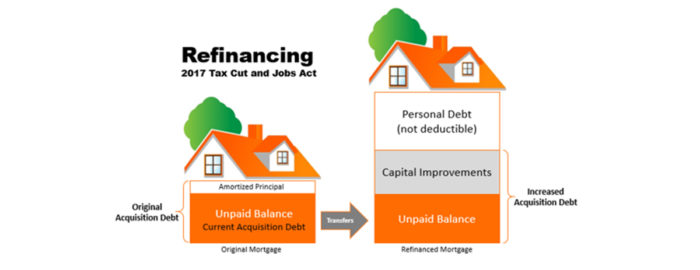

Your acquisition debt does not include finance charges but is a dynamic number that changes as you live in your home. Think of it as the principal balance on your loan. It decreases with the normal amortization as your principal balance is paid down. Increasing acquisition debt usually only happens after a home is bought by borrowing additional funds against your equity in the home and using them for capital improvements on the home.

In this example, let’s assume you bought a home and have a brand-new mortgage on the home. Then after your home has a significant appreciation, you decide to refinance the home and take some of that equity in cash. We will also say that the refinance is less than $750,000 which might make you think you can deduct all the interest.

The current acquisition debt is transferred to your new mortgage. Only the portion of the funds used to pay for new capital improvements can be combined to equal the increased acquisition debt. The interest on that part of the mortgage is deductible as qualified mortgage interest.

The remainder of your refinanced mortgage is attributed to personal debt and the interest paid on that is not deductible.

This is where you need to be careful because lenders are not really interested in giving you a fully tax-deductible loan. They want to give you a loan that makes them a profit and will be repaid according to set terms. Lenders are required by law to provide borrowers annual statements which shows how much interest you paid during the year.

These annual statements can cause confusion by making you believe you can deduct more interest than is allowed. It is up to you, the homeowner, to keep track of your acquisition debt and only deduct what is classified as qualified mortgage interest.

Your tax professional can be very helpful in determining this amount. It is important to notify them that you have refinanced a home during the tax year for which the taxes are being reported. For more information, see IRS Publication 936 and Homeowners Tax Guide. Home equity debt has not been allowed since the beginning of 2018.

Want Some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!