When finalizing a divorce, an important decision to be made is the division of assets between the husband and the wife. This exercise appears to be simple enough: put a value on each asset from the marriage and then divide those assets per a mutual signed agreement.

When finalizing a divorce, an important decision to be made is the division of assets between the husband and the wife. This exercise appears to be simple enough: put a value on each asset from the marriage and then divide those assets per a mutual signed agreement.

A challenge arises when you need to make a fair division of these assets between the husband and wife after their cash value has been determined.

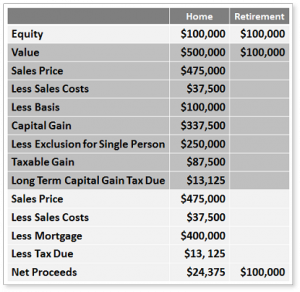

Let’s create two main assets for this example. One, a retirement account and the second being equity in an existing home. Both at a value of $100,000. Logic would say that you would split the two and give each spouse one item. Unfortunately, when the ex-spouse with the home decides to sell it, the resulting net proceeds could equal at lot less than the value of the retirement account.

To further demonstrate my example, let’s say the home returns a lower price of $475,000 because of the conditions of the current market. On top of that, the former marriage jointly owned the home for a lot of years and even refinanced it a few times which pulled money out of the home. Our divorced spouse sells the home, but does not recoup the earned profit.

Now being single, tax laws only allow the ex-spouse to a $250,000 exclusion and he or she will need to pay tax on anything over it. If we tally sales costs, remaining mortgage balance and tax to be paid on any gain, our ex-spouse nets $24,375 from the sale of the home. Compare this to the $100K the other spouse received as part of the settlement. I have assisted single home buyers in locating Fairfax homes for sale in which they can start their new lives.

My message for you, is, that if you are experiencing this type of situation consider and examine any potential expenses when converting marriage assets to cash after a divorce. Another option to this situation might be to hire a professional Realtor to sell the home under the agreement that all liens against the home will be paid and taken care of before any remaining profit is to be split equally between the parting spouses.

My message for you, is, that if you are experiencing this type of situation consider and examine any potential expenses when converting marriage assets to cash after a divorce. Another option to this situation might be to hire a professional Realtor to sell the home under the agreement that all liens against the home will be paid and taken care of before any remaining profit is to be split equally between the parting spouses.

As always, seek the advice of your tax expert prior to making any final financial decisions. For real estate advice, contact me for your answers.