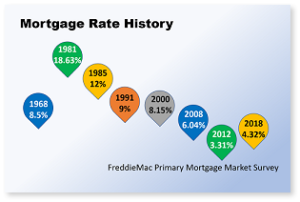

Back in 1968, mortgage rates were 8.5 percent. Then the following year, rates dropped to 7 percent. Homebuyers were able to buy a 15 to 20 percent larger home with the same payment if they could get their mortgage assumed.

Back in 1968, mortgage rates were 8.5 percent. Then the following year, rates dropped to 7 percent. Homebuyers were able to buy a 15 to 20 percent larger home with the same payment if they could get their mortgage assumed.

Back then FHA and VA mortgages were very popular for certain price ranges and these institutes allowed anyone to assume their mortgage regardless of credit rating. If you could find someone who could take over your note, you were free to qualify for another mortgage.

Then in October 1981, mortgage rates soared to 18.63 percent. The mortgage on a $250,000 home had a monthly principal and interest payment of $3,896.46. Although that sounds astronomical, people were still buying home and these homes were good investments.

After four more years, rates were still over 12 percent. The monthly payment had dropped to $2,571.53 for the same $200,000 home. And this made people excited to pay only 2/3 of what they were paying four years earlier.

Jump forward to late 1991 where loan rates dropped below 9 percent and the monthly payment dropped to $2, 015.16. Then at the beginning of the 21st century, rates dropped to 8.15 percent and that dropped the monthly payment to $1,860.62. But rates stayed steady during this decade.

Even during the late 2008 housing bubble, the rates were 6.04 percent and the payment dropped to $1,505.31. By 2009, loan rates fell to below 5 percent. The lowest reported mortgage rate was 3.31 percent for November 2012 and a monthly payment of $1,096.27.

Then loan rates kept fluctuating over the years until now with most experts expecting them to rise above 5 percent by the end of 2018. Loan rates have increased over the last six weeks to around 4.38 percent which results in payments of $1,240.12 monthly.

Now the average mortgage rate has been a little over 8 percent for the past 47 years. But mortgage and real estate markets are cyclical. Rates have been historically low over a long period of time now and experts are predicting them to continue rising. These low rates enable buyers who can’t pay cash to buy homes. If we look back over the history, anything between today’s rate and 8 percent is a bargain. But don’t wait for the rates to keep climbing, let me help you become a homeowner now so when those rates do rise you will be sitting pretty.

Want some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!